Cineplex Sells Cineplex Digital Media to Creative Realities for C$70M: What It Means for DOOH and Retail Media

Cineplex Inc. has agreed to sell its digital place-based media arm, Cineplex Digital Media (CDM), to U.S. digital signage provider Creative Realities, Inc. (CRI) for C$70 million in cash. Cineplex frames the move as a strategic refocus on core entertainment while bolstering the balance sheet; CRI calls it a transformational acquisition that doubles the size of the company and expands its North American footprint.

Key deal points

- Purchase price: C$70 million, payable in cash, subject to customary post-closing adjustments.

- Closing timing: expected in the coming weeks (October 2025 timeframe), pending regulatory approvals and standard conditions.

- Post-sale roles: Cineplex will remain the exclusive advertising sales agent for CDM-operated DOOH networks across Canada under a long-term agreement.

Why Cineplex is selling

For Cineplex, CDM has been a strong, award-winning B2B solutions business running large digital networks across retail, QSR, and entertainment venues. But post-pandemic strategy has centered on theater operations and experiences, with a steady push to strengthen the balance sheet. Proceeds from this transaction are expected to be used for debt reduction, opportunistic share buybacks, and general corporate purposes.

Why Creative Realities is buying

CRI gets immediate scale in Canada plus expanded vertical coverage across North America. Management is guiding to at least US$10 million in annual cost synergies by the end of 2026, on top of cross-sell opportunities in software, services, and retail media/AdTech.

Industry context: consolidation and the DOOH flywheel

This is another cross-border consolidation signal in digital signage and DOOH. The market rewards platform scale (hardware lifecycle, managed services, CMS standardization) and media scale (measurable audience, unified ad ops). As CRI integrates CDM, expect rationalization of platforms, tighter service SLAs, and a bigger combined media story for retail and venue partners.

Competitors

CDM never used Scala, Poppulo/Four Winds Interactive, Omnivex, Navori, Signagelive, etc., for its retail/cinema networks. Lots of those vendors market to cinema/retail, but we couldn’t verify a CDM deployment with them.

What to watch next

- Integration roadmap & product stack: Will the combined company standardize on a single CMS or maintain dual tracks? Synergy targets suggest an aggressive integration posture.

- Media monetization in Canada: With Cineplex still selling ads, brands and agencies should see continuity—plus new cross-border packaging for North American buys.

- Capital allocation at Cineplex: Watch for debt paydown, buybacks, or premium-format investments.

- Regulatory and closing cadence: Any delay could push synergy timing and revenue recognition into later quarters.

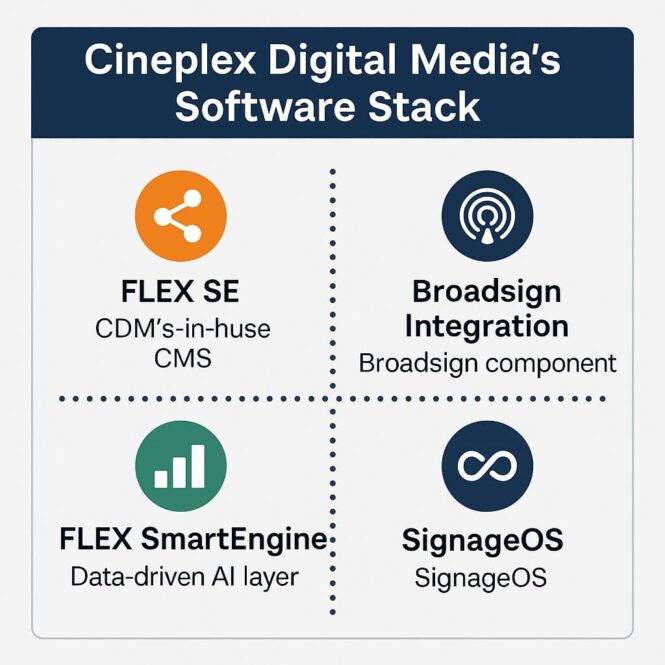

Sidebar: Cineplex Digital Media’s Software Stack

Cineplex Digital Media (CDM) built much of its signage network on its own proprietary platform:

-

FLEX SE (CMS) – CDM’s in-house content-management system, designed for multi-location retail and QSR networks.

-

FLEX SmartEngine – A data-driven AI layer that adjusts screen content dynamically based on audience and context.

-

Broadsign integration – CDM also appears to have used Broadsign components for publishing and device management (a CDM-hosted Broadsign Publish login exists).

-

SignageOS – Mentioned in infrastructure documentation for device visibility and monitoring, suggesting a hybrid software environment.

Together, these indicate that CDM’s value wasn’t only its physical screens or ad contracts—it included a mature CMS + analytics platform interoperating with established third-party tools like Broadsign. For Creative Realities, this means acquiring both a network footprint and a tested software foundation that could merge with its own ReflectView and AdLogic solutions.

(Sources: CDM Experiences website; ReadyWorks case study; Broadsign domain artifacts; Cineplex corporate press materials.)

Sources

- Creative Realities news release

- Cineplex announcement (via Yahoo Finance)

- Boxoffice Pro coverage

- Digital Signage Today

More Cineplex Creative Realities Related

Deeper Dive

Cineplex Digital Media (CDM) mainly ran on its own signage stack, but there’s credible evidence they also used Broadsign components (and integrated with SignageOS) in parts of the operation. Zero public proof they standard-ran other third-party CMSs across their networks.

What’s documented publicly

1) CDM’s own CMS/platform

-

FLEX SE (CMS) — CDM’s in-house content management system positioned for multi-site retail/QSR deployments. cdmexperiences.com+1

-

FLEX SmartEngine — their data/ML layer that personalizes and optimizes content in real time. cdmexperiences.com+2mediafiles.cineplex.com+2

Implication: A lot of CDM’s networks likely ran on this proprietary combo (FLEX SE + SmartEngine), which is part of the value Creative Realities is acquiring.

2) Broadsign in the stack (publishing & ops)

-

A CDM-branded Broadsign Publish login endpoint exists (

go.cdmpublish.com), which strongly suggests CDM used Broadsign’s platform (at least for some publishing/workflows). go.cdmpublish.com -

A recent ReadyWorks case study about “the digital signage team” at Cineplex mentions integrations with BroadSign and SignageOS for device visibility and compliance — again indicating Broadsign was in the tooling mix. readyworks.com

Implication: Even with an in-house CMS, CDM appears to have leveraged Broadsign (and SignageOS) for parts of the network lifecycle — e.g., player management, publishing flows, or media side operations.

What I did not find good evidence for

-

No reliable, first-party or trade-press confirmation that CDM standardized on Scala, Poppulo/Four Winds Interactive, Omnivex, Navori, Signagelive, etc., for its retail/cinema networks. Lots of those vendors market to cinema/retail, but we couldn’t verify a CDM deployment with them. (Some articles you’ll find are about other venues or general cinema signage, not Cineplex/CDM specifically.)