Ten Takeaways from Herhausen Study

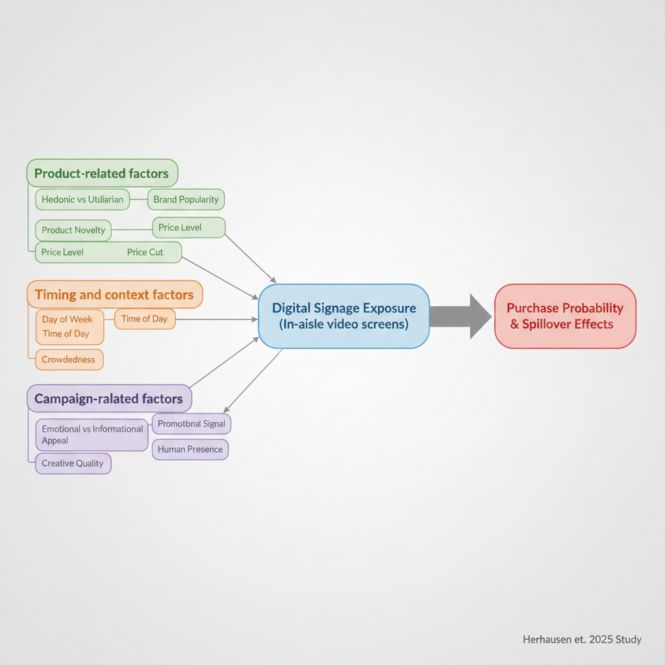

Writeup on Sixteen-Nine is quite good covering the new study on digital signage and ROI. The big number is 8% lift but that is specific to this study group and lots of conditions in play. RFID in store aisles with directed audio (ouch). Hedonistic more effective than discounts. See where still disagreements or questions remain below.

The study only specifies: one retailer, 10 large grocery stores, western Europe, ~108,000 sq ft, ~€25M/year per store, mainly food and household items, using a third‑party digital-signage provider with a national media agency. If we had to guess — Carrefour Belgium is publicly known to use Scala-based in‑store media and digital signage, and it operates large-format hyper/supermarkets, so it is a plausible structural match among many.

Here are ten takeaways that capture what matters most in this study.

- Digital signage works, on average

- Facing screens while walking store aisles tends to nudge people toward buying what’s shown – data shows an 8.1% lift in purchase odds. This comes from looking at 237 ad pushes and nearly thirty million customers

- What happens is new buying shows up, rather than people just hoarding more

- People see the product out in the open, so they tend to pick it up more often. Yet once bought, they do not pay extra for that specific item. Instead of rushing to grab it early, like discounts cause, nothing shows people are buying sooner or hoarding. Unlike deals based on lowered prices, this method does not push bulk purchases

- Pleasure–driven picks work well here. New things catch on fast. What’s trending fits right in. Low cost helps them sell quickly

- Stronger reactions show up with fun–focused goods rather than practical ones. Popularity of a brand plays a role too. When something new hits the market, responses tend to grow. Price matters – cheaper items often see bigger impact

- Beside the clock, what’s happening around shifts outcomes. Moments change when surroundings tilt one way or another

- Weekends bring a boost in lift – especially as daylight fades. Sunshine helps, while rain tends to dull it. Crowds inside the store also push numbers up. Later hours see stronger results than early ones

- Better results come from being near. Distance tends to reduce impact. Proximity shows a clear advantage when tested. Nearness works more effectively every time measured

- Around 2 percent more likely – just move the item ten meters nearer to the display. Being physically close makes a difference, quietly boosting visibility each step forward

- Emotional content beats informational content

- What tugs at heartstrings often moves numbers more than facts alone. Emotion–driven campaigns tend to lift results beyond what plain information can achieve. Feelings spark responses that logic sometimes misses. Messages tied to emotion go further than those relying only on data

- Surprisingly, deal signs hurt how well signage works

- The real drop in prices doesn’t strengthen how well signs work. When deal hints are added to the design, it weakens what digital signs can achieve on their own

- What lifts one player can lift others nearby, while leaving competitors behind

- A single sign showing one item can make people more likely to buy different things made by that company. It also boosts interest in similar kinds of goods across the board. At the same time, fewer folks tend to choose rival options when they see it

- Campaign wearout vs system learning

- One by one, single ad efforts fade – people notice them less after a while. Still, the whole sign setup works better over months, simply because customers start recognizing it. Brands do too. What sticks around is how sound might shape attention if played daily, week after week

- Money talks when signs work like store ads

- Manufacturers see a stronger response – around 0.18 – from ads compared to standard short-term campaigns. Retailers might recover sign costs within one or two years. Additional gains mainly arrive through ad space sales rather than increased item profits.

Where disagreement or open questions remain

Despite the stronger empirical base, several points of contention and open debate remain:

-

Role of price and promo cues

-

Classic promotion literature and some earlier in-store work predict that price cues and promo signals amplify impulse buying.

-

This study finds no added effectiveness from price cuts and a negative interaction for promotional signals with digital signage, suggesting inspirational/emotional content may outperform deal-focused content in this context.

-

Whether this strategy can be pushed into other formats, countries, and non-grocery categories is still unresolved.

-

-

Content type and optimal creative

-

Earlier studies offered mixed results on informational vs affective content.

-

The new findings strongly favor emotional appeals, but only for the specific high-vividness, trigger-on-approach format studied; questions remain about:

-

Humor, celebrities, and other creative dimensions.

-

How much human imagery is optimal before it distracts from the product.

-

-

-

How widely it applies across formats and settings

-

The experiments are from one western European grocery retailer using RFID-triggered, aisle-mounted screens with directed audio; older studies involved different formats (endcaps, projections, registers, etc.) and found more variable effects.

-

It remains unclear how these new empirical generalizations transfer to:

-

Non-grocery or specialty retail (fashion, electronics, services).

-

Basket-only shopping, smaller formats, or markets with different shopper norms.

-

Online analogs (on-site display/banner ads at digital POS).

-

-

-

Individual-level mechanisms and long-term effects

-

The study infers mechanisms (self-control depletion, variety seeking, circadian effects) from patterns in moderators but cannot directly measure attention or psychological states due to privacy constraints.

-

Loyalty, long-run brand equity, and frequency effects remain largely unmeasured because the system is not linked to individual identities or loyalty cards; this keeps open debate about whether signage primarily drives short-term trial, ongoing habit, or both.

-

-

Treatment intensity and bystanders

-

The experiments measure “intention-to-treat” (assigned exposure) rather than actual viewing time; bystanders and partial exposures are counted as control, likely making estimates conservative.

-

There is still no consensus on dose–response: how much exposure, for how long, and at what angle/distance is optimal.

-